A Blast from the Past and a Glimpse into the Future

Gold and silver market prices have always been an important indicator of the global economic stability. This article explores 2023 market conditions for gold and silver, compares them to a previous decades, and predicts their future performance. Additionally, we detail how these precious metals have historically been considered a hedge against inflation and examine daily mining statistics.

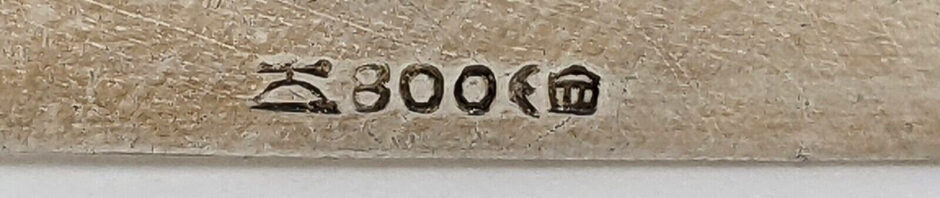

Historical Data on Gold and Silver Prices

| Year | Gold Price | Silver Price |

|---|---|---|

| 1920-1929 | $20.67 | $0.65 |

| 1930-1939 | $35.00 | $0.33 – $0.65 |

| 1940-1949 | $35.00 | $0.71 |

| 1950-1959 | $35.00 | $0.91 |

| 1960-1969 | $35.00 – $42.00 | $1.30 – $1.95 |

| 1970-1979 | $130.00 – $615.00 | $4.40 – $21.00 |

| 1980-1989 | $612.00 | $15 |

| 1990-1999 | $383.00 | $5.20 |

| 2000-2009 | $603.00 – $1,096.00 | $6.00 – $18.00 |

| 2000-2009 | $1,225.00 – $1,668.00 | $20.00 – $35.00 |

| Year | Gold Price | Silver Price |

Market Conditions Resembling the 1970s

The present market conditions for gold and silver closely mirror the 1970s, a time of economic uncertainty, high inflation rates, political tensions, and volatility in global markets. This era also saw a growing interest in precious metals as safe-haven assets, which led to increased investment in physical gold and silver as well as the expansion of gold and silver-backed financial products.

Future Predictions for Gold and Silver

As we look to the future, gold and silver markets are likely to continue experiencing ongoing volatility, influenced by factors such as geopolitical risks, fluctuating economic conditions, and varying interest rates. Additionally, the increased adoption of digital assets, such as cryptocurrencies and blockchain technology, may impact the demand for gold and silver. Environmental and sustainability concerns are also expected to play a role in shaping the precious metals market, with stricter regulations on mining practices and a shift towards responsible sourcing and ethical investments.

Gold and Silver as Inflation Hedges

Historically, gold and silver have been thought of as a hedge against inflation due to their ability to preserve value and maintain purchasing power over time. This characteristic has made them a popular choice for counterbalancing inflationary pressures on fiat currencies. Another reason these precious metals are considered a hedge is their limited supply. The finite amount of gold and silver available ensures their lasting value, making them an attractive asset for investors seeking portfolio diversification. Precious metals often perform inversely to traditional investments, reducing risk by spreading investments across different assets.

Mining Statistics

In terms of production, approximately 3,300 tons of gold are mined annually, which translates to roughly 9 tons per day. Silver mining sees even higher numbers, with around 27,000 tons mined annually, or about 74 tons per day. These mining statistics underline the ongoing demand for gold and silver in the global market.

Summary

The current gold and silver market conditions most closely resemble those of the 1970s, a period marked by economic uncertainty, high inflation, and increased demand for precious metals. As the future unfolds, these markets will likely continue to experience volatility, although they may be influenced by the growth of digital assets and environmental concerns. Gold and silver have historically been considered a hedge against inflation, thanks to their ability to preserve value and their finite supply.